Picture 1 of 16

Gallery

Picture 1 of 16

Have one to sell?

Stochastic Calculus for Finance I The Binomial Asset Pricing Model Steven E. PB

US $28.00

ApproximatelyS$ 36.12

or Best Offer

Condition:

“Pre-owned with normal signs of wear and tear. The cover, spine, and back show visible scuffs. Some ”... Read moreabout condition

Acceptable

A book with obvious wear. May have some damage to the cover but integrity still intact. The binding may be slightly damaged but integrity is still intact. Possible writing in margins, possible underlining and highlighting of text, but no missing pages or anything that would compromise the legibility or understanding of the text.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Shipping:

US $5.22 (approx S$ 6.73) USPS Media MailTM.

Located in: Las Vegas, Nevada, United States

Delivery:

Estimated between Fri, 3 Oct and Mon, 6 Oct to 94104

Returns:

30 days return. Seller pays for return shipping.

Coverage:

Read item description or contact seller for details. See all detailsSee all details on coverage

(Not eligible for eBay purchase protection programmes)

Seller assumes all responsibility for this listing.

eBay item number:136445480433

Item specifics

- Condition

- Acceptable

- Seller Notes

- Book Title

- Stochastic Calculus for Finance I: The Binomial Asset Pricing Mod

- ISBN

- 9780387249681

About this product

Product Identifiers

Publisher

Springer New York

ISBN-10

0387249680

ISBN-13

9780387249681

eBay Product ID (ePID)

47048122

Product Key Features

Number of Pages

Xv, 187 Pages

Publication Name

Stochastic Calculus for Finance I Vol. 1 : the Binomial Asset Pricing Model

Language

English

Subject

Probability & Statistics / General, Finance / General, Calculus, Applied

Publication Year

2005

Type

Textbook

Subject Area

Mathematics, Business & Economics

Series

Springer Finance Ser.

Format

Trade Paperback

Dimensions

Item Weight

23.3 Oz

Item Length

9.3 in

Item Width

6.1 in

Additional Product Features

Intended Audience

Scholarly & Professional

Dewey Edition

22

Number of Volumes

1 vol.

Illustrated

Yes

Dewey Decimal

332.0151922

Table Of Content

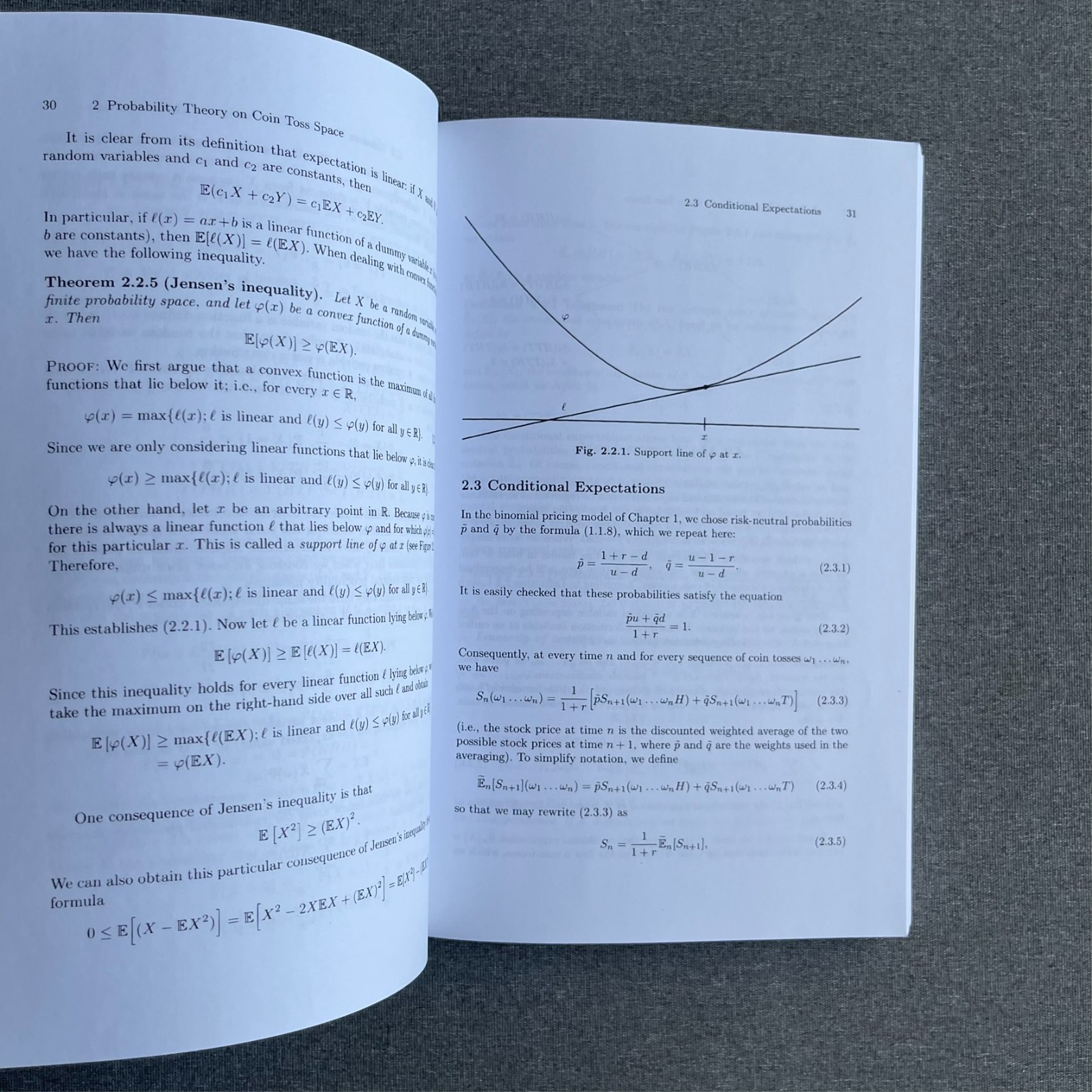

1 The Binomial No-Arbitrage Pricing Model.- 1.1 One-Period Binomial Model.- 1.2 Multiperiod Binomial Model.- 1.3 Computational Considerations.- 1.4 Summary.- 1.5 Notes.- 1.6 Exercises.- 2 Probability Theory on Coin Toss Space.- 2.1 Finite Probability Spaces.- 2.2 Random Variables, Distributions, and Expectations.- 2.3 Conditional Expectations.- 2.4 Martingales.- 2.5 Markov Processes.- 2.6 Summary.- 2.7 Notes.- 2.8 Exercises.- 3 State Prices.- 3.1 Change of Measure.- 3.2 Radon-Nikodým Derivative Process.- 3.3 Capital Asset Pricing Model.- 3.4 Summary.- 3.5 Notes.- 3.6 Exercises.- 4 American Derivative Securities.- 4.1 Introduction.- 4.2 Non-Path-Dependent American Derivatives.- 4.3 Stopping Times.- 4.4 General American Derivatives.- 4.5 American Call Options.- 4.6 Summary.- 4.7 Notes.- 4.8 Exercises.- 5 Random Walk.- 5.1 Introduction.- 5.2 First Passage Times.- 5.3 Reflection Principle.- 5.4 Perpetual American Put: An Example.- 5.5 Summary.- 5.6 Notes.- 5.7 Exercises.- 6 Interest-Rate-Dependent Assets.- 6.1 Introduction.- 6.2 Binomial Model for Interest Rates.- 6.3 Fixed-Income Derivatives.- 6.4 Forward Measures.- 6.5 Futures.- 6.6 Summary.- 6.7 Notes.- 6.8 Exercises.- Proof of Fundamental Properties of Conditional Expectations.- References.

Synopsis

This book evolved from the first ten years of the Carnegie Mellon professional Master's program in Computational Finance. The contents of the book have been used successfully with students whose mathematics background consists of calculus and calculus-based probability. The author does not assume familiarity with advanced mathematical concepts from measure-theoretic probability, but rather develops the necessary tools from this subject informally within the text. Many classroom-tested examples, exercises, and intuitive arguments are presented throughout the book., Stochastic Calculus for Finance evolved from the first ten years of the Carnegie Mellon Professional Master's program in Computational Finance. The content of this book has been used successfully with students whose mathematics background consists of calculus and calculus-based probability. The text gives both precise statements of results, plausibility arguments, and even some proofs, but more importantly intuitive explanations developed and refine through classroom experience with this material are provided. The book includes a self-contained treatment of the probability theory needed for stochastic calculus, including Brownian motion and its properties. Advanced topics include foreign exchange models, forward measures, and jump-diffusion processes. This book is being published in two volumes. The first volume presents the binomial asset-pricing model primarily as a vehicle for introducing in the simple setting the concepts needed for the continuous-time theory in the second volume. Chapter summaries and detailed illustrations are included. Classroom tested exercises conclude every chapter. Some of these extend the theory and others are drawn from practical problems in quantitative finance. Advanced undergraduates and Masters level students in mathematical finance and financial engineering will find this book useful. Steven E. Shreve is Co-Founder of the Carnegie Mellon MS Program in Computational Finance and winner of the Carnegie Mellon Doherty Prize for sustained contributions to education.

LC Classification Number

H61.25

Item description from the seller

Popular categories from this store

Seller feedback (4,989)

- Automatische feedback van eBay- Feedback left by buyer.Past monthBestelling op tijd geleverd zonder problemen

- Automatische feedback van eBay- Feedback left by buyer.Past monthBestelling op tijd geleverd zonder problemen

- 2***8 (2)- Feedback left by buyer.Past monthVerified purchaseArrived quickly and in good used shape. Great value!!